Spatial Vision’s Managing Director, Glenn Cockerton, provides an overview of trends and developments in industries including technology, geospatial, space, and surveying.

As most do at this time, I have given some thought to the events of this year and how they are impacting our industry.

The IT sector has seen lots of activity with moves to increase the level of digital transformation across government continuing apace. Significant government budgets have been seen for a large range of IT projects, both national and state, particularly as part of the post COVID economic stimulus programs of many jurisdictions.

The AIIA noted:

“In pleasing news for the technology and innovation sector, the [Federal] Government will deliver major billion-dollar investments in creating digital capability across the economy including the SME sector; from 5G and broadband infrastructure, government digitisation projects, to investments in digital skills and cyber uplift capability.” (source)

Not just limited to government, evidence that these trends are alive and well in medium to large corporates as well.

Nonetheless, the increased role played by some of the major platform vendors (eg Salesforce) has been noticeable.

Anecdotally it seems that traditional land surveying has been impacted significantly by the slowdown in new land development in some parts of the country. Urban construction has also slowed in some areas impacting surveying firms. Big infrastructure spends by governments throughout the country are creating opportunities for practices willing to reconsider their service offers. As a result, traditional surveying companies are having to adapt rapidly, to diversify their revenue streams.

The impact for the large contracting firms arising from the infrastructure boom may not be all positive with questions over the long-term profitability of some players (eg Grocon, Lend Lease). Some consolidation and thinning of the herd may well continue into 2021.

For much of the rest of the geospatial industry (particularly the geospatial application and analytical companies) the business environment during 2020 would seem to have been very positive.

Significant investments are being made in:

Increased focus on emergency management following the inquiries into bushfires and other events.

- The move to GDA2020 and the dynamic datum

- Smart Cities and Digital Twins

- ANZLIC’s vision to progress from 2D to 4D Foundation Data

- Artificial Intelligence / Machine Learning from Geospatial Perspective

- Projects like Victoria’s Digital Cadastre Modernisation project and the recent approach to the market by LINZ on behalf of ANZLIC to develop a coordinated 3D cadastral data model

- Climate change impacts and adaptability

- Increased focus on emergency management following the inquiries into bushfires and other events being held both Federally and at the state and territory level and a renewed interest in remote sensing, real-time mapping and better communication of this information to response teams and the public.

- Australia and New Zealand’s operational Satellite Based Augmentation System (SBAS) has officially been renamed the Southern Positioning Augmentation Network, or SouthPAN. SouthPAN will be the first SBAS in the Southern Hemisphere, and is led by Geoscience Australia and Land Information New Zealand (LINZ) under the Australia New Zealand Science, Research and Innovation Cooperation Agreement.

The government’s national targets for employment growth and to triple the size of Australia’s space industry has proved to be a catalyst for many areas of the spatial industry. This is because of the strong interdependencies between space and spatial: space-based communications, positioning systems, earth observation and the increasing array of geospatial data products derived from these sources underline these dependencies. Indeed, for much space activity, it is the end users within the geospatial ecosystem that often provide the investment justification.

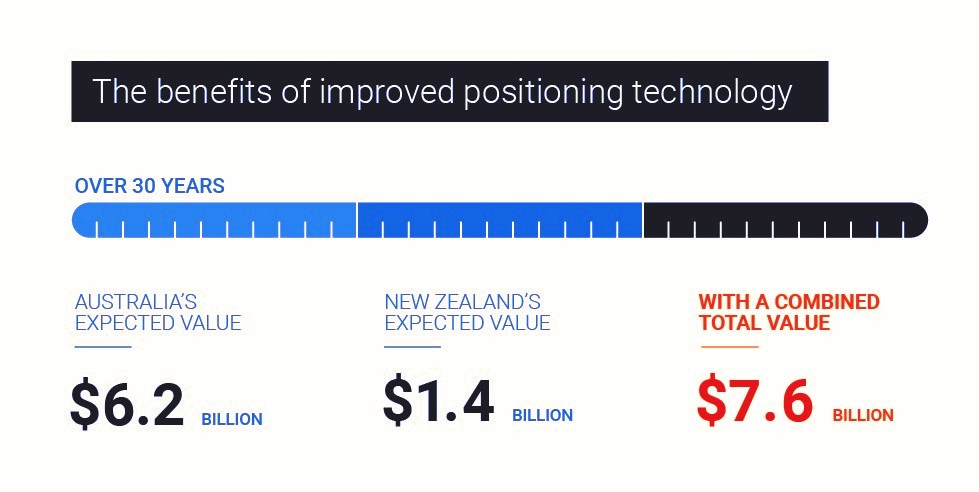

The benefits of improved positioning technology via Geoscience Australia

The formation of the Australian Space Agency in 2019, and the successful establishment of the SmartSAT CRC, increased GeoINT (spatially enabled intelligence) capability in Australia’s defence forces, together with a heightened interest in Australia’s sovereign capabilities has meant that government interest in this area is at an all-time high.

A group of industry leaders have come together to start the process of developing a 2030 Space and Spatial Industry Roadmap aimed at highlighting the strong interdependencies between the two sectors.

The pace of industry consolidation seen over 2018-2019 seems to have slowed during this last year. This may be as a result of the impact of COVID but I expect this process will resume in 2021. COVID has had a major impact for our tertiary institutions. The loss of much of the overseas student demand and need to deliver teaching on-line by default has resulted in universities needing to make substantial changes to not only the way they teach but also the experience they offer students. Many universities are experiencing major challenges adjusting to these new conditions. Geospatial science and surveying are niche disciplines and need to have significant industry support if they are to continue to provide our work force of the future.

Overseas, much has happened of note. The UN’s Global Geospatial Information Management Committee of Experts (UN-GGIM) has substantially progressed the Integrated Geospatial Information Framework (IGIF), its strategic guide to develop and strengthen national geospatial information management.

Another UN initiative, its Sustainable Development Goals (or SDGs) are also gaining currency. In Australia, some very good examples of how the SDGs can help frame policy development and strategic planning are emerging. One of the best has come from the Victorian Commissioner for Environmental Sustainability and its State of the Environment Report.

SDGs provide:

- A framework for reporting across complex and disparate areas of social, economic and environmental policy

- A framework that is internationally agreed and widely supported

- A common language for measuring progress against goals and targets

- Broad support from across business, government and community.

It is expected that the adoption of the SDG framework will continue to expand in 2021.

Geospatial Knowledge Infrastructure has been a significant topic of discussion in both global and local communities, extending our understanding of Spatial Data Infrastructures.

The World Geospatial Industry Council’s release of Location Data Privacy White Paper, the UN-GGIM’s third Future Trends Report (depicting a vision for the next decade) and the launch of the UK Geospatial Strategy are few of the key highlights for the year.

In the world of Australian geospatial associations, 2021 saw the announcement of a proposal for the merger of SSSI and SIBA|GITA, a move that will be welcomed by many. Our industry’s annual national conference, Locate20, planned for Brisbane in April, was deferred as a result of the COVID emergency.

What’s Coming in 2021?

We know that additional geospatial capabilities will be required to address many of the economic, environmental and social initiatives of government, industry and communities post-COVID. Geospatial technologies, data and analytics will make these issues easier to tackle. The contribution of geospatial capabilities is directly applicable in areas such as climate change, energy reform, regional industry adjustment, urban planning, water, forest management, mining, transportation improvements, public health, and many other sectors of the economy. Combined appropriately with allied technologies such as IT and space, geospatial solutions will underpin many of the digital transformation initiatives as well. It is possible that Australia will need to look at becoming more self sufficient in many aspects of the economy. Supply chain risks are likely to be of growing significance in the future.

Geospatial companies will have a continuing and increasingly important role to play in building Australia’s future.